Accounting and Tax

Understanding the Tax Benefit Rule: A Guide for OnlyFans Creators

As an OnlyFans creator, understanding the tax benefit rule is crucial when navigating taxes. One essential concept to grasp is the tax benefit rule. This rule impacts how your income and deductions are treated, especially when you recover an amount previously deducted in a prior taxable year. Understanding the tax benefit rule and effective tax planning is crucial for managing your finances efficiently. Here are ten essential tax benefit rules and tips to help you navigate taxes effectively.

Keep Accurate Records

Accurate record-keeping is key to effective tax planning under the Tax Benefit Rule. Track all your income and expenses meticulously. This ensures you report the correct gross income and claim all allowable deductions. Use apps or software to simplify this task.

Understand the Tax Benefit Rule

The tax benefit rule states that if you recover an amount previously deducted in a prior year, you must include it in your gross income for the current year, to the extent it provided a tax benefit. For example, if you deducted $500 for a business expense last year and received a refund this year, the tax benefit rule requires you to report that $500 as income this year.

Separate Business and Personal Expenses

Separate your income attributable to business and personal expenses. Only deduct business-related expenses on your tax return. This helps avoid confusion and potential issues with tax authorities.

Deduct All Allowable Expenses

Claim all expenses related to your OnlyFans business, such as marketing costs, equipment, and subscriptions. Under the Tax Benefit Rule, deducting these expenses reduces your taxable income. Always refer to the latest tax guidelines for deductible expenses.

Plan for Self-Employment Taxes

As an OnlyFans creator, you are self-employed and need to pay self-employment taxes in addition to regular income taxes. Set aside a portion of your income throughout the year to cover these taxes, for example, so you’re not caught off guard when it’s time to file your return.

Use Estimated Tax Payments

Due to irregular income, make estimated tax payments quarterly later year on. This helps you avoid underpayment penalties and manage cash flow better. The IRS provides guidelines on calculating and making these payments.

Consider Home Office Deductions

If you use part of your home exclusively for your OnlyFans business, you may qualify for a home office deduction. This can include a portion of your rent or mortgage, utilities, and other related expenses. Ensure you meet IRS requirements to claim this deduction.

Keep an Eye on Gross Income Thresholds

Your gross income determines the extent of your tax bracket and eligibility for certain deductions and credits. Monitor your income and plan your expenses to stay within advantageous thresholds. Deferring some income to a later year can help you stay in a lower tax bracket.

Understand Recovery and Deduction Rules

If you recover an amount previously deducted, you must include it in your income for the year it was recovered. If the recovered amount or deduction didn’t provide a tax benefit in the prior year, you don’t need to include it in your current year’s income.

Consult a Tax Professional

Tax laws are complex, and the rules for taxpayers and self-employed individuals can be intricate. Consulting a tax professional can help you navigate these complexities, ensuring compliance with regulations while maximizing your tax benefits.

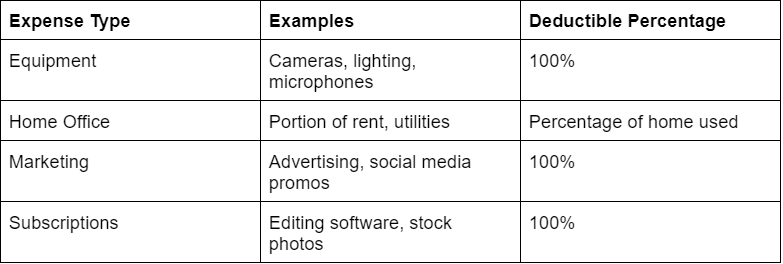

Example Table: Deductible Expenses for OnlyFans Creators Key Terms to Remember

- Gross Income: Total income before deductions.

- Prior Taxable Year: The previous year’s tax period.

- Tax Benefit: The reduction in tax liability due to a deduction.

- Recovered Amount: An amount received back that was previously deducted.

- Taxpayer: The individual or entity subject to taxes.

FAQs

What is the tax benefit rule?

If you recover a previously deducted amount, include it in your current year’s gross income, to the extent it provided a tax benefit in the prior year.

How can I differentiate between business and personal expenses?

Business expenses are necessary for OnlyFans operations, like equipment and marketing. Personal expenses are unrelated. Use separate bank accounts and keep detailed records to differentiate.

How do estimated tax payments work for OnlyFans creators?

Make quarterly estimated tax payments based on expected income to avoid penalties. The IRS provides guidelines and worksheets for calculations.

What should I do if I recover an amount previously deducted?

Include recovered any deduction amounts in your income for the year they are recovered if the initial deduction provided a tax benefit in the prior year.

Conclusion

Understanding the tax benefit rule and implementing effective tax planning strategies each taxable year can significantly impact your financial health as an OnlyFans creator. Keep accurate records each taxable year, understand the rules, and seek professional advice when needed. By doing so, you can minimize your tax liability each taxable year and ensure compliance with tax laws, allowing you to focus more on creating content and growing your business.

At The OnlyFans Accountant, we help creators understand complex rules like the tax benefit rule and apply them correctly to protect their earnings. Our team gives you clear, practical steps so you can stay compliant, lower your tax bill, and avoid costly mistakes. Contact us today to schedule your free consultation and get expert tax support tailored to your creator business.